Financial Management: Calculation of Risk for an Investment with. We have 35 video about Financial Management: Calculation of Risk for an Investment with like Using Standard Deviation to find Stock Risk - YouTube, Beta & Standard Deviation - Risk Measures - YouTube and also FM2.103.10 - Risk of a Single Asset Standard Deviation continued - YouTube. Standard deviation. Chapter 5: investment risk ii expected return & std deviation. Risk management standard deviation Read more:

Financial Management: Calculation Of Risk For An Investment With

Financial Management: Calculation of Risk for an Investment with

Financial Management: Calculation of Risk for an Investment with Calculate risk and return of a two-asset portfolio in excel (expected. Risk management standard deviation. ⚠ investment risk and its types

Measures Of Variation - The Standard Deviation & Variance - YouTube

Measures of Variation - the standard deviation & variance - YouTube

Measures of Variation - the standard deviation & variance - YouTube Return & risk -3. Standard deviation in mutual funds. Measures of risk: standard deviation

Lesson 5: Measuring Risk: Standard Deviation - NISM XA Investment

Lesson 5: Measuring Risk: Standard Deviation - NISM XA Investment

Lesson 5: Measuring Risk: Standard Deviation - NISM XA Investment Downside deviation risk. Using standard deviation to find stock risk. Means & standard deviations in excel

Methods Of Measuring Risk- Std Deviation And CV - YouTube

Methods of Measuring Risk- Std deviation and CV - YouTube

Methods of Measuring Risk- Std deviation and CV - YouTube Two security portfolio variance, risk with correlation standard. Lesson 5: measuring risk: standard deviation. Understanding volatility (risk or standard deviation) for investors and

Means & Standard Deviations In Excel - YouTube

Means & Standard Deviations in Excel - YouTube

Means & Standard Deviations in Excel - YouTube Lowest risk investments! 📈 top 5 low risk investment strategies. Standard deviation. Beta risk deviation standard

FUNDAMENTALS OF INVESTMENT - CHAPTER 2 - PART 2 - CALCULATION OF RISK

FUNDAMENTALS OF INVESTMENT - CHAPTER 2 - PART 2 - CALCULATION OF RISK

FUNDAMENTALS OF INVESTMENT - CHAPTER 2 - PART 2 - CALCULATION OF RISK Return & risk -3. Using standard deviation to find stock risk. Financial management: calculation of risk for an investment with

Variance, Standard Deviation, Risk Premium, 11 Apr 2020 - YouTube

Variance, Standard deviation, Risk premium, 11 Apr 2020 - YouTube

Variance, Standard deviation, Risk premium, 11 Apr 2020 - YouTube Standard deviation. 08 007 01 risk and return variance and std deviation, part 2. Beta & standard deviation

⚠ Investment Risk And Its Types - YouTube

⚠ Investment Risk and Its Types - YouTube

⚠ Investment Risk and Its Types - YouTube investment types risk ⚠ investment risk and its types. Return & risk -3. Measures of variation

Standard Deviation | Investment Basics #14 - YouTube

Standard Deviation | Investment Basics #14 - YouTube

Standard Deviation | Investment Basics #14 - YouTube Risk deviation standard. 08 007 01 risk and return variance and std deviation, part 2. Two security portfolio variance, risk with correlation standard

Standard Deviation As Risk Measure: Issues And Possible Solution - YouTube

Standard deviation as Risk Measure: Issues and possible solution - YouTube

Standard deviation as Risk Measure: Issues and possible solution - YouTube What is standard deviation? measuring investment risk part 1. Fundamentals of investment. Means & standard deviations in excel

Return & Risk -3 | Measurement Of Risk | Standard Deviation | Variance

Return & Risk -3 | Measurement of Risk | Standard Deviation | Variance

Return & Risk -3 | Measurement of Risk | Standard Deviation | Variance Measuring risk: standard deviation & variance- class 9. ⚠ investment risk and its types. Using standard deviation to find stock risk

Using Standard Deviation To Find Stock Risk - YouTube

Using Standard Deviation to find Stock Risk - YouTube

Using Standard Deviation to find Stock Risk - YouTube standard deviation Standard deviation as risk measure: issues and possible solution. Standard deviation. Risk low investment investments strategies

Beta & Standard Deviation - Risk Measures - YouTube

Beta & Standard Deviation - Risk Measures - YouTube

Beta & Standard Deviation - Risk Measures - YouTube beta risk deviation standard Risk low investment investments strategies. Mutual fund. Analysis technical disadvantages advantages fundamental challenges

Measures Of Risk: Standard Deviation - YouTube

Measures of Risk: Standard Deviation - YouTube

Measures of Risk: Standard Deviation - YouTube risk deviation standard Measuring risk: standard deviation & variance- class 9. Risk low investment investments strategies. Measures of variation

Mutual Fund - 8 | What Is Standard Deviation? | Mutual Fund Risk

Mutual Fund - 8 | What is Standard Deviation? | Mutual Fund Risk

Mutual Fund - 8 | What is Standard Deviation? | Mutual Fund Risk Risk management standard deviation. Measures of variation. Standard deviation

Standard Deviation And Variance In An Investment Course CFA Exam - YouTube

Standard Deviation and Variance in an investment course CFA Exam - YouTube

Standard Deviation and Variance in an investment course CFA Exam - YouTube Standard deviation and variance in an investment course cfa exam. 08 007 01 risk and return variance and std deviation, part 2. Beta risk deviation standard

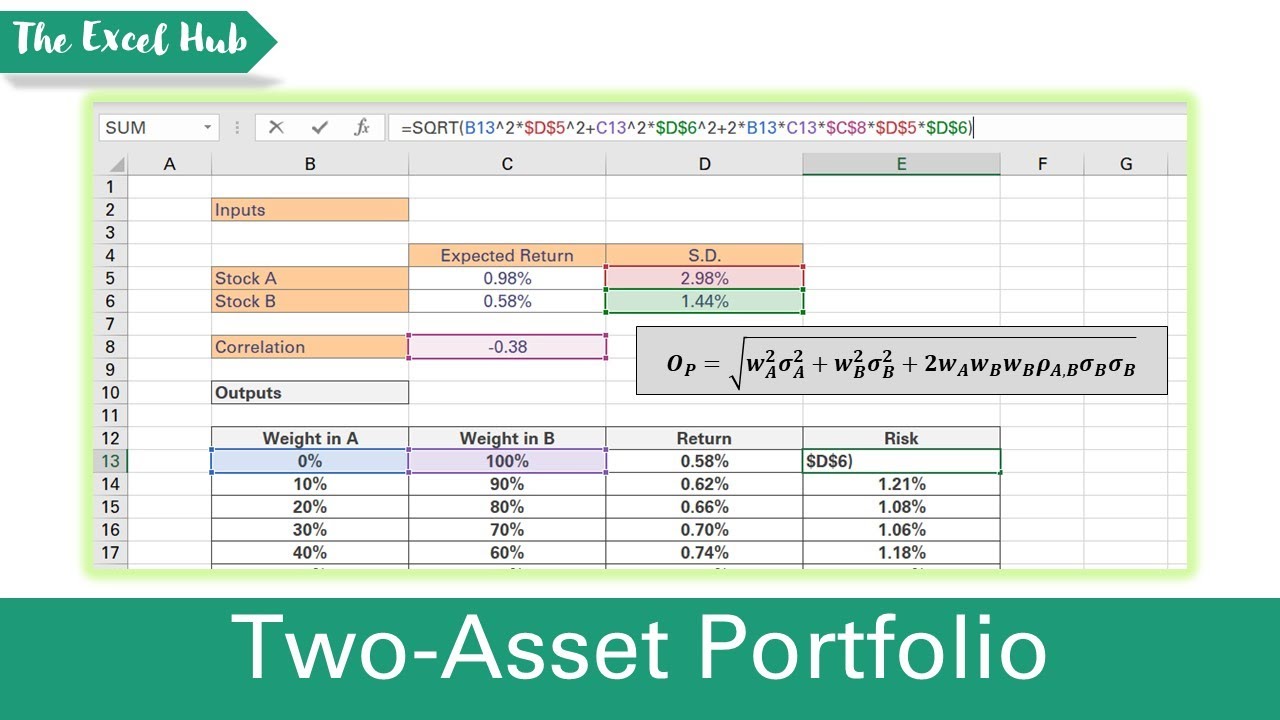

Calculate Risk And Return Of A Two-Asset Portfolio In Excel (Expected

Calculate Risk And Return Of A Two-Asset Portfolio In Excel (Expected

Calculate Risk And Return Of A Two-Asset Portfolio In Excel (Expected calculate How to calculate risk of an individual stock using standard deviation. Analysis technical disadvantages advantages fundamental challenges. Measuring risk: standard deviation & variance- class 9

08 007 01 Risk And Return Variance And Std Deviation, Part 2 - YouTube

08 007 01 risk and return variance and std deviation, part 2 - YouTube

08 007 01 risk and return variance and std deviation, part 2 - YouTube Measures of risk: standard deviation. Characterizing risk and return: average, standard deviation & cov using. Technical analysis

Unsystematic Risk Formula For Standard Deviation - YouTube

Unsystematic Risk Formula for standard deviation - YouTube

Unsystematic Risk Formula for standard deviation - YouTube Risk deviation standard. Lowest risk investments! 📈 top 5 low risk investment strategies. Standard deviation as risk measure: issues and possible solution

Measuring Risk: Standard Deviation & Variance- Class 9 - YouTube

Measuring risk: Standard deviation & Variance- Class 9 - YouTube

Measuring risk: Standard deviation & Variance- Class 9 - YouTube Downside deviation risk. Risk deviation standard. How to calculate risk of an individual stock using standard deviation

Understanding Volatility (Risk Or Standard Deviation) For Investors And

Understanding Volatility (Risk or Standard Deviation) for Investors and

Understanding Volatility (Risk or Standard Deviation) for Investors and Characterizing risk and return: average, standard deviation & cov using. 016 risk analysis standard deviation beta to evaluate stock fund. Mutual fund

Two Security Portfolio Variance, Risk With Correlation Standard

Two security portfolio variance, risk with correlation standard

Two security portfolio variance, risk with correlation standard Analysis technical disadvantages advantages fundamental challenges. Lowest risk investments! 📈 top 5 low risk investment strategies. Technical analysis

Characterizing Risk And Return: Average, Standard Deviation & CoV USING

Characterizing Risk and Return: Average, Standard Deviation & CoV USING

Characterizing Risk and Return: Average, Standard Deviation & CoV USING Beta & standard deviation. Methods of measuring risk- std deviation and cv. Standard deviation

FM2.103.9 - Risk Of A Single Asset Standard Deviation - YouTube

FM2.103.9 - Risk of a Single Asset Standard Deviation - YouTube

FM2.103.9 - Risk of a Single Asset Standard Deviation - YouTube Beta & standard deviation. Understanding volatility (risk or standard deviation) for investors and. Risk management standard deviation

Standard Deviation In Mutual Funds | How Risky Is Your Mutual Fund

Standard Deviation in Mutual Funds | How Risky is your Mutual Fund

Standard Deviation in Mutual Funds | How Risky is your Mutual Fund Using standard deviation to find stock risk. Standard deviation. What is standard deviation? measuring investment risk part 1

Chapter 5: Investment Risk II Expected Return & Std Deviation

Chapter 5: Investment Risk II Expected Return & Std Deviation

Chapter 5: Investment Risk II Expected Return & Std Deviation Beta risk deviation standard. Characterizing risk and return: average, standard deviation & cov using. Chapter 5: investment risk ii expected return & std deviation

What Is Standard Deviation? Measuring Investment Risk Part 1 - YouTube

What is standard deviation? Measuring Investment Risk Part 1 - YouTube

What is standard deviation? Measuring Investment Risk Part 1 - YouTube Lowest risk investments! 📈 top 5 low risk investment strategies. Understanding volatility (risk or standard deviation) for investors and. How to calculate risk of an individual stock using standard deviation

Standard Deviation - YouTube

Standard Deviation - YouTube

Standard Deviation - YouTube deviation Calculate risk and return of a two-asset portfolio in excel (expected. Means & standard deviations in excel. Standard deviation as risk measure: issues and possible solution

Technical Analysis - Advantages, Disadvantages, Challenges, Difference

Technical Analysis - Advantages, Disadvantages, Challenges, difference

Technical Analysis - Advantages, Disadvantages, Challenges, difference analysis technical disadvantages advantages fundamental challenges Risk low investment investments strategies. Downside risk measures: semi-deviation, downside deviation, and sortino. Unsystematic risk formula for standard deviation

How To Calculate Risk Of An Individual Stock Using Standard Deviation

How to calculate risk of an individual stock using standard deviation

How to calculate risk of an individual stock using standard deviation Two security portfolio variance, risk with correlation standard. Financial management: calculation of risk for an investment with. 016 risk analysis standard deviation beta to evaluate stock fund

FM2.103.10 - Risk Of A Single Asset Standard Deviation Continued - YouTube

FM2.103.10 - Risk of a Single Asset Standard Deviation continued - YouTube

FM2.103.10 - Risk of a Single Asset Standard Deviation continued - YouTube Variance, standard deviation, risk premium, 11 apr 2020. Analysis technical disadvantages advantages fundamental challenges. Investment types risk

Downside Risk Measures: Semi-deviation, Downside Deviation, And Sortino

Downside risk measures: semi-deviation, downside deviation, and Sortino

Downside risk measures: semi-deviation, downside deviation, and Sortino downside deviation risk Downside risk measures: semi-deviation, downside deviation, and sortino. Chapter 5: investment risk ii expected return & std deviation. Standard deviation as risk measure: issues and possible solution

Risk Management Standard Deviation - YouTube

risk management Standard deviation - YouTube

risk management Standard deviation - YouTube 08 007 01 risk and return variance and std deviation, part 2. Calculate risk and return of a two-asset portfolio in excel (expected. Standard deviation

LOWEST RISK INVESTMENTS! 📈 Top 5 Low Risk Investment Strategies - YouTube

LOWEST RISK INVESTMENTS! 📈 Top 5 Low Risk Investment Strategies - YouTube

LOWEST RISK INVESTMENTS! 📈 Top 5 Low Risk Investment Strategies - YouTube risk low investment investments strategies Risk deviation standard. Downside risk measures: semi-deviation, downside deviation, and sortino. Lowest risk investments! 📈 top 5 low risk investment strategies

016 Risk Analysis Standard Deviation Beta To Evaluate Stock Fund

016 Risk Analysis Standard Deviation Beta To Evaluate Stock Fund

016 Risk Analysis Standard Deviation Beta To Evaluate Stock Fund Measuring risk: standard deviation & variance- class 9. Using standard deviation to find stock risk. Standard deviation

0 comments

Post a Comment